5 Questions About Applying for Social Security Answered (Part 1)

Social Security Timeline: Important Moments

1935: President FDR signed the SS Act into law

1939: Benefits added for workers’ dependents and survivors

1940: Benefits changed from lump sum to monthly

1950: First COLA authorized (77% increase)

1956 & 60: Benefits added for disabled workers (& dependents)

1961: Early retirement added - reduced benefit at age 62

1975: Annual automatic COLA added

1983: Gradually raising full retirement age to 67; making 50% of SS taxable (above $25k single, $32k joint)

1993: Adding the 85% of SS taxable tier (above $34k single, $44k joint)

1994: The SSA official website was launched

2000: Retirement earnings test eliminated for those above FRA

2023: The SS trust fund is projected to run short in 2035, if no further action taken, after which only about 80% of benefits could be paid

2024: Congress repealed the Windfall Elimination Provision (WEP) and the Government Pension Offset (GPO)

2025: In August 2024, a campaign promise was made to stop taxing Social Security benefits, meaning the 50% and 85% tax tiers would be removed. However, President Trumps recent House bill proposal offers a new tax break for seniors instead: an additional $6,000 deduction for those 65 and older. This "enhanced deduction for seniors" would apply to both itemizers and those who take the standard deduction, potentially lowering taxes for about 56 million Americans aged 65 and older.

How to apply for Social Security

Begin discussing Social Security planning before you turn 60. Understanding your options and the best time to start taking benefits can greatly improve your long-term financial security.

You can apply to start your Social Security payments up to 4 months early. For full retirement age (FRA) claims and survivor claims, payments can be made up to 6 months retroactively. If you take these retroactively in a lump sum, your official start date and monthly benefit will go back 6 months, and you will lose 6 months of delayed retirement credits.

Three ways to apply:

Create or log in to your “my Social Security Account” at www.ssa.gov. You can use it to get a replacement card, check your application status, estimate future benefits, or manage current benefits.

Set a time to visit the Social Security office for help with the process.

Schedule a phone call with the social security office (1-800-772-1213).

Social Security Benefits Documents Needed:

Social Security card or record of your social security number

Original birth certificate

Copy of your W2 form and /or self-employment tax return

Direct deposit information (account number and routing number)

Spousal Benefits Documents Needed:

Social Security card or record of your social security number

Original birth certificate

Marriage certificate

Final divorce decree, if applying a a divorced spouse

1. When can you apply for Social Security?

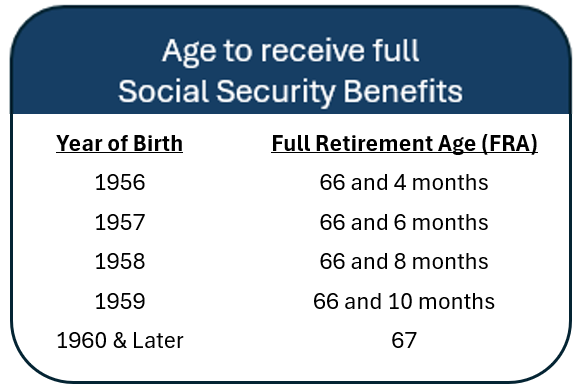

If you qualify for social security (40 credits, 10 years of minimum work history, based on highest 35 years of earnings) you can apply as early as age 62 (30% reduction), delayed retirement credits end at age 70.

* Full Retirement Age

** Combined Income = Adjusted Income + Nontaxable Interest + ½ of your SS Benefit

2. What if I apply early and change my mind?

Within 12 months of claiming social security, you are allowed to pay back all the benefits received. If anyone else is claiming benefits on your record those would also need repaid.

If you wait until full retirement age (FRA), you can suspend your benefits and begin to earn delayed credits up until age 70 (no payback of previous benefits needed to suspend).

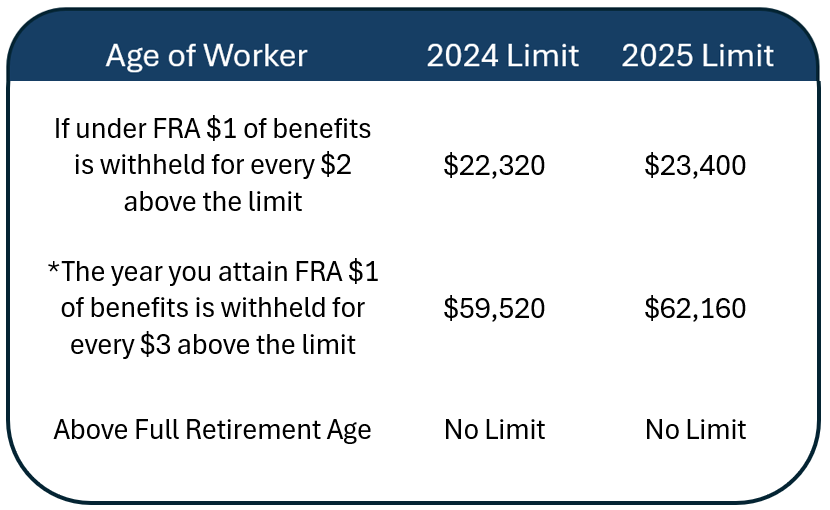

3. Impact of working while

collecting social security benefits?

* Applies only to the months of earnings prior to the month of obtaining full retirement age (FRA).

When is the earliest I can

collect spousal or survivor benefits?

4. If my social security becomes taxable, should I withhold?

Withholding from your Social Security is not part of the initial application process. However, you can file W4‐V to have federal withholding (not state). The options are limited to 0%, 7%, 10%, 12% and 22%.

The withholding percent is applied after Medicare Part B premiums are subtracted.

Consideration: Since you can only withhold federal taxes and have limits on your withholding rates, think about increasing the amount you withhold from your tax-deferred accounts. You can usually choose a specific dollar amount and manage both federal and state withholdings.

5. When can I expect my first social security payment?

Your first Social Security payment will be paid one month after your desired application date. If you apply in January, the first payment will come in February (always on a Wednesday).

If your birthdate is within the first 10 days of the month your monthly payment will occur on the second Wednesday of the month; if within 10 to 20 days, the payment will occur on the third Wednesday; if in the last part of the month, you’ll receive payment on the fourth Wednesday.

Consideration: Line up your cash flow and if possible, have your withdrawals from tax‐deferred or taxable accounts hit two weeks later than your Social Security payment to maintain a consistent cash flow like the paycheck process you may be familiar and comfortable with.

6. When is the best time to apply: age 62, 67, or 70?

Ville Wealth Management is a Registered Investment Adviser in the state of Ohio. Advisory services are only offered to clients or prospective clients where Ville Wealth Management and its representatives are properly registered or exempt from registration. “Likes” should not be considered a positive reflection of the investment advisory services offered by Ville Wealth Management. Brian Jaros is an investment adviser representative of Ville Wealth Management. The firm is a registered investment adviser and only conducts business in jurisdictions where it is properly registered, or is excluded or exempted from registration requirements. Registration as an investment adviser is not an endorsement of the firm by securities regulators and does not mean the adviser has achieved a specific level of skill or ability. The information presented on this post is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Comments should not be construed as an offer to buy or sell, or a solicitation of an offer to buy or sell the investments mentioned. A professional adviser should be consulted before implementing any of the strategies discussed. Investments involve varying degrees of risk, and there can be no assurance that any specific investment or strategy will be suitable or profitable for a client's portfolio. All investment strategies can result in profit or loss.