Think Your Index Fund Avoids Concentration Risk?

Is the S&P 500 Index Still a Good Investment?

Warren Buffett has been advising for many years that most individual investors would benefit from putting their money into the S&P 500 Index Fund due to its simplicity, cost-effectiveness, and attractive long-term growth potential. This index provides a broad representation of the U.S. equity market, covering approximately 80% of the total market capitalization. While the S&P 500 is often perceived as providing broad diversification by encompassing 500 different companies across various industries and sectors, the actual situation is considerably different when analyzed more closely.

*As of 7/23/2025

In recent times, the market capitalization of the top ten companies within the S&P 500 has increased dramatically, causing potential concentration issues for investors who are seeking true diversification.

Historically, these top ten companies made up about 24% of the Index's total assets based on market capitalization, but more recently, their combined market value has grown to approximately 37%.

This shift highlights the increasing concentration of market value among a few dominant companies within the index, which may significantly affect the overall risk exposure and performance characteristics for investors who rely heavily on this fund as their primary vehicle for diversification.

There is no universally accepted definition for what exactly constitutes a concentrated position within an investment portfolio. Generally speaking, when an investment in a single stock comprises more than 5% of the total portfolio value, advisors at T. Rowe Price consider it significant enough to warrant careful evaluation and potential action to manage the risk. However, once a holding surpasses the 10% threshold, it represents a substantially higher risk level that demands more immediate and thoughtful planning in order to mitigate potential downsides and preserve portfolio health.

Source: Finaeon, S&P 500, Citi Global Insights

Are Index Funds Over Concentrated?

Data as of 7/28/2025. Source: Morningstar

Let’s cut to the chase: if you invest solely in the Russell 1000 Growth or the S&P 500, then yes, you do carry some concentration risk due to the heavy weighting of certain large-cap stocks within these indexes. However, if your investments are part of a well-diversified portfolio encompassing many different indexes and asset classes, such as those carefully managed by Ville Wealth Management, the answer is no—you do not face the same level of concentration risk. Diversification helps spread exposure across various sectors, industries, and types of investments, which reduces the impact of any single stock’s performance on your overall portfolio.

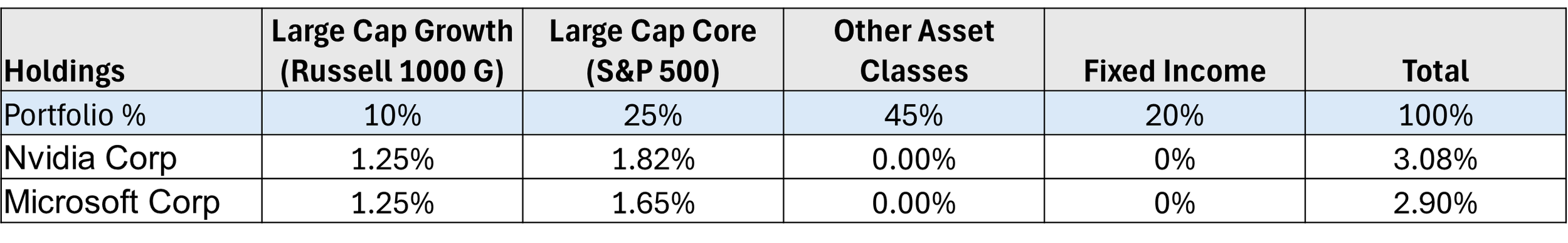

To understand how using multiple indexes and asset classes can reduce concentration risk, let’s take a closer look at Nvidia and Microsoft, which represent significant holdings within both the Russell 1000 Growth and the S&P 500 Indexes.

Portfolio only invested in Russell 1000 Growth or the S&P 500 Index.

Although Nvidia holds a 12.54% weighting in the Russell 1000 Growth Index and a 7.29% weighting in the S&P 500 Index, when you diversify your investment portfolio across many different asset classes and indexes, the overall concentration risk to Nvidia can be significantly lowered.

80/20 Diversified Portfolio invested across several indexes and asset classes including the S&P 500 and Russell 1000 Growth.

For instance, consider a diversified portfolio invested across many indexes structured with an 80/20 allocation—80% in equities and 20% in cash or fixed income. If your allocation to large-cap growth (Russell 1000 Growth) stocks is approximately 10%, and your allocation to large-cap core (S&P 500) stocks is about 25%, then your total exposure to Nvidia would be around 3.08%, compared to the 12.54% exposure you would have if you invested strictly within the Russell 1000 Growth and the 7.29% exposure you would have in the S&P 500. This highlights the benefit of broad diversification across several indexes and asset classes in managing individual stock risk within your overall portfolio. Similarly, Microsoft could be reduced to 2.9%.

Bottom Line

To protect your portfolio and reduce concentration risk, diversify across many asset classes and indexes.

See my prior blog on Market Volatility which recommends rebalancing regularly, not investing short term money, maintaining your asset allocation, keeping fees and expenses low, keeping cash for spending and updating your financial plan.

Ville Wealth Management is a Registered Investment Adviser in the state of Ohio. Advisory services are only offered to clients or prospective clients where Ville Wealth Management and its representatives are properly registered or exempt from registration. “Likes” should not be considered a positive reflection of the investment advisory services offered by Ville Wealth Management. Brian Jaros is an investment adviser representative of Ville Wealth Management. The firm is a registered investment adviser and only conducts business in jurisdictions where it is properly registered, or is excluded or exempted from registration requirements. Registration as an investment adviser is not an endorsement of the firm by securities regulators and does not mean the adviser has achieved a specific level of skill or ability. The information presented on this post is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Comments should not be construed as an offer to buy or sell, or a solicitation of an offer to buy or sell the investments mentioned. A professional adviser should be consulted before implementing any of the strategies discussed. Investments involve varying degrees of risk, and there can be no assurance that any specific investment or strategy will be suitable or profitable for a client's portfolio. All investment strategies can result in profit or loss.