Opportunity Valley: Avoid Large Tax Bills in Retirement

Opportunity Valley

Future Tax Problem for those with Large Retirement Accounts

If you are over the age of 50 and have successfully built-up substantial retirement accounts, you might face a serious tax issue in the future. For the last 30 years, federal tax rates have been low, easing financial burdens for many. However, our national debt is nearing record levels, which could lead to higher tax rates to help manage this debt. Once you turn 73—the age for required minimum distributions (RMDs)—your retirement accounts may be so large that your RMDs will push you into the highest tax brackets for the rest of your life, even if tax rates do not rise. Additionally, you'll also encounter IRMAA (income-related monthly adjustment) charges, which will raise your Medicare Part B and D premiums to the highest rates, complicating your retirement planning further.

The Secure Act 2.0 has changed how your heirs access your retirement accounts. They can no longer stretch distributions over their lifetimes and must now withdraw all funds within 10 years. If your account is worth over $2 million when you pass, this could lead to a significant tax burden of around $200,000 in annual withdrawals, likely moving your heirs into the highest tax brackets.

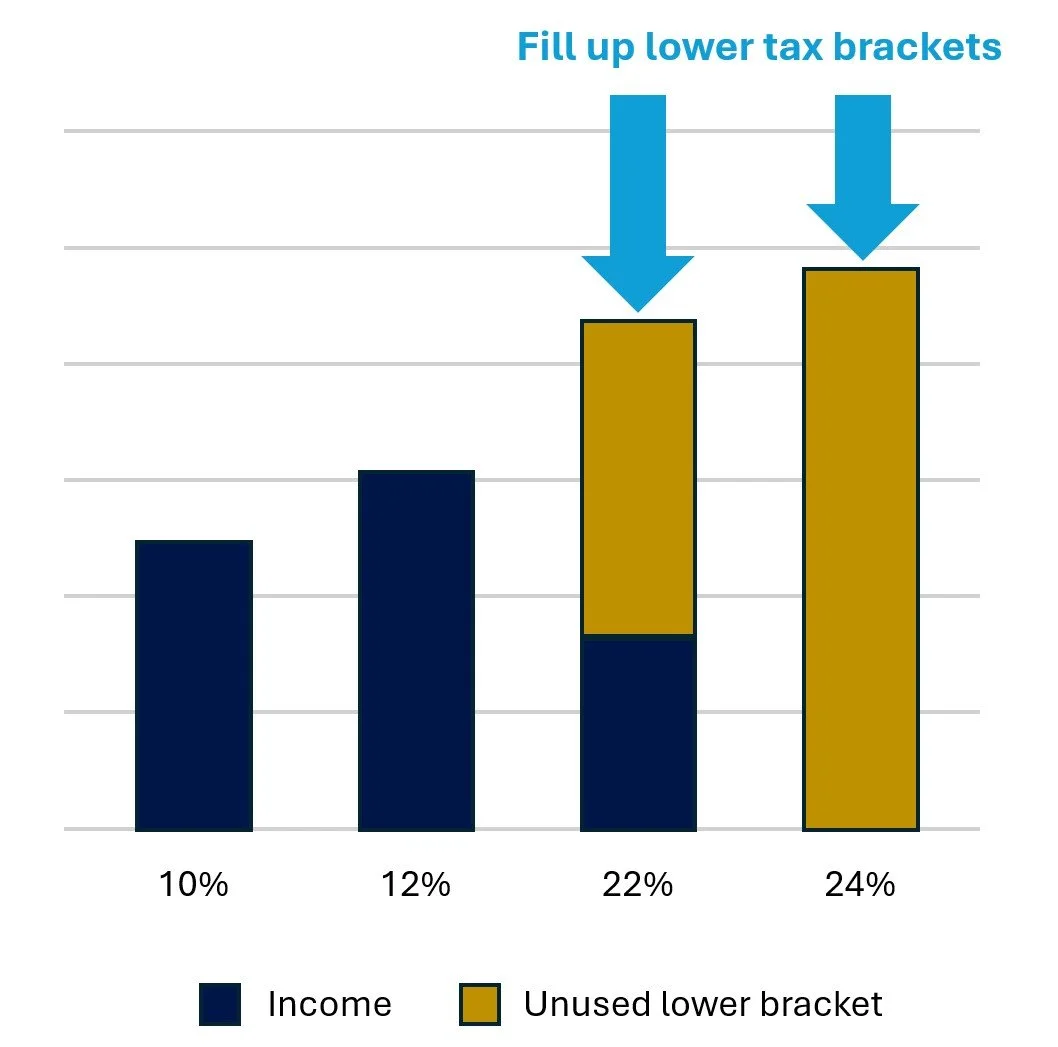

The average retirement age in the U.S. is 65 for men and 63 for women. If you delay social security benefits, you enter what I call the opportunity valley. There are effective strategies to maximize this time and make the most of lower tax rates. By carefully withdrawing money from your retirement accounts, you can take advantage of these lower taxes, which may reduce your future Required Minimum Distributions (RMDs) and lower your overall tax rate. Common strategies include Roth conversions or direct withdrawals from retirement accounts, which I refer to as filling up your lower tax brackets and filling up the opportunity valley.

Many future retirees may be heading for a tax tsunami, lets list out the potential tax traps on the horizon:

Large retirement accounts creating large future required minimum distributions increasing future marginal tax rates

15% or 20% capital gains tax rates

Social Security Tax (50% or 85% taxable)

3.8% Medicare Surtax

IRMMA Tax on Medicare Part B and D

2025 Joint Tax Rate Schedule

* Modified Adjusted Gross Income

Potential Solutions

Some specific approaches to consider include potentially delaying the initiation of Social Security benefits and strategically increasing withdrawals from retirement accounts.

Additionally, options like Roth IRA and Spousal Roth IRAs should be evaluated, and if eligibility is an issue, exploring strategies such as Back Door Roth IRAs or Spousal Back Door Roth IRAs could be beneficial. Other alternatives include contributing to a Roth 401(k), utilizing Health Savings Accounts, or considering Cash Value Life Insurance as viable solutions. If your 401(k) plan allows for after-tax contributions, the Mega Back Door Roth may also present an advantageous option worth exploring.

Sample Illustration: John and Mary Sample

John (55) and Mary (52) have over $3 million in tax-deferred retirement accounts. When they turn 73, required withdrawals (RMDs) may push their taxes to the highest rates. If they start moving some money to a Roth IRA at 65 and delay Social Security benefits until 70, their after-tax savings could grow a lot. This plan might add about $6.8 million to their savings and save nearly $1.4 million in taxes. Each case is unique—consult your advisor for a plan that fits you.

Alternative Strategy Compromise:

Combining Roth conversions with regular withdrawals from retirement accounts can help fill income gaps, save on federal and state taxes, and avoid higher Medicare premiums.

Ville Wealth Management is a Registered Investment Adviser in the state of Ohio. Advisory services are only offered to clients or prospective clients where Ville Wealth Management and its representatives are properly registered or exempt from registration. “Likes” should not be considered a positive reflection of the investment advisory services offered by Ville Wealth Management. Brian Jaros is an investment adviser representative of Ville Wealth Management. The firm is a registered investment adviser and only conducts business in jurisdictions where it is properly registered, or is excluded or exempted from registration requirements. Registration as an investment adviser is not an endorsement of the firm by securities regulators and does not mean the adviser has achieved a specific level of skill or ability. The information presented on this post is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Comments should not be construed as an offer to buy or sell, or a solicitation of an offer to buy or sell the investments mentioned. A professional adviser should be consulted before implementing any of the strategies discussed. Investments involve varying degrees of risk, and there can be no assurance that any specific investment or strategy will be suitable or profitable for a client's portfolio. All investment strategies can result in profit or loss.