10 Strategies for Caring for an Aging Parent

Overview

Caring for an aging parent is a journey filled with both challenges and rewards. Many of my clients in their fifties find themselves balancing careers, their own children, and now the evolving needs of their parents. If you’re navigating this stage, you’re not alone and a thoughtful, proactive approach can make all the difference.

70% of Americans turning 65 will need some form of LTC in their lifetime [Market.biz, 2025].

Women require care for an average of 3.7 years; men for 2.2 years [Avior, 2025].

About 2.5 million Americans are currently in LTC facilities [Everything Policy, 2025].

According to recent data [Morningstar, July 2025], the national average annual cost for long-term care is:

Nursing home, private room: $127,750/year ($120,450 in Ohio)

Nursing home, semi-private: $111,325/year ($108,405 in Ohio)

Assisted living: $70,800/year ($66,000 in Ohio)

In-home care: $75,000–$78,000/year for 44 hours/week ($73,216 in Ohio)

According to Long Term Care (LTC) planning specialists, an aging parent should have $300,000 to $700,000 in liquid, cashable assets set aside specifically for potential LTC costs. This does not include their home, but does include IRAs, 401(k)s, and taxable accounts. For those with less, a combination of insurance, home equity, and Medicaid planning may be more appropriate. [Kiplinger, 2024]

Other Considerations:

Geography: Costs can vary dramatically by state and city.

Asset Liquidity: Home equity may be used, but isn’t always easily accessible in a crisis.

Legacy Goals: If you want to preserve wealth for heirs, you may need a higher asset buffer.

Backup Plan: If assets are depleted, Medicaid is the safety net, but this means spending down to state limits.

Top Ten Strategies

1. Start with the Conversation Early - With Empathy

According to the latest guidance, the best time to talk with your parents about their future is before a crisis hits. Use the “40-70 rule”: if you’re in your forties or your parents are in their seventies, it’s time to start these discussions [Comfort Keepers, 2025].

Approach the conversation with respect for your parent’s autonomy.

Make it an ongoing dialogue, not a one-time event.

Ask open-ended questions: “How do you feel about your current living situation?” or “What would you want if you needed more help day-to-day?”

2. Lean on Support Systems - And Take Care of Yourself

Caregiver burnout is real. Set realistic boundaries, build a support network, and don’t hesitate to seek respite care or join a support group [BetterHelp, 2025].

Practice self-care: Maintain your own health, relationships, and interests.

Hold Family Meetings: Regularly convene all stakeholders (siblings, spouses, trusted advisors) to discuss care plans, finances, and division of responsibilities, reducing the risk of misunderstandings and disputes. [Kiplinger, Apr 2025].

Assign Roles: Clearly define who will handle medical, financial, and legal decisions if a parent loses capacity. Consider appointing co-trustees or co-agents for checks and balances.

Ask for help: Use community resources, professional advocates, and family.

Join support groups: Sharing experiences with others can reduce stress and provide practical tips.

“The mission of the child is to keep their parent safe and healthy. The older adult, though, doesn’t want to be wrapped up. Rather, they want to maintain their sense of autonomy and advocacy.”

Dr. Erlene Rosowsky, Clinical Psychologist [NPR, Aug 2025]

3. Home Safety & Medications

Aging brings gradual changes. Watch for patterns: like missed appointments, confusion with finances, or changes in hygiene. These items may suggest more support may be needed [Solace Health, Aug 2025].

Health & Medical: Keep an up-to-date list of medications and doctors. Designate a healthcare proxy and prepare advanced directives.

Utilize Technology: Use medication reminder apps, telehealth services, and home monitoring devices to make caregiving easier and safer.

Home Safety: Consider modifications like grab bars, improved lighting, and removing tripping hazards.

4. Create a Comprehensive Plan

Centralize Documentation: Create a secure digital (or physical) repository for all key documents—wills, trusts, POAs, healthcare directives, insurance policies, account info, and contact lists for advisors and doctors. Ensure at least two trusted individuals have access in case of emergency [J.P. Morgan Private Bank, May 2025].

Review and Register POAs: Make sure powers of attorney are current and registered with all relevant financial institutions for quick action if a parent becomes incapacitated.

Update Estate Plans: Move beyond a simple will. Consider revocable and irrevocable trusts for asset protection, tax minimization, and legacy goals. Trusts can shield assets from lawsuits, divorce, and creditors, and provide for special needs or charitable giving [PA Estate Planners, 2025].

Set up automatic bill payments to prevent missed payments due to memory issues or hospitalization. Consider consolidating accounts for easier monitoring and management.

What-If Analysis: Model multiple scenarios (e.g., parent needs 24/7 care, sudden health decline, loss of capacity) and have contingency funding and care plans in place [J.P. Morgan Private Bank, 2025].

Regular Review: Revisit all plans annually or upon any significant change in health, finances, or family dynamics.

5. Investment Strategies for Caring for Aging Parents

Start with a holistic review: According to [Trustworthy, May 2025], begin by assessing your parent’s financial goals, risk tolerance, and income needs. Many seniors hold overly conservative portfolios (cash, CDs, fixed income) that risk falling behind inflation.

Consolidate accounts: Take inventory and consider consolidating scattered accounts with one or two custodians. This simplifies management and helps prevent missed RMDs or overlooked assets. Ensure transfers are between similar account types (e.g., IRA to IRA) to avoid triggering taxes.

Don’t avoid equities entirely: Seniors often underestimate the need for equities to keep pace with inflation and future care costs. A diversified mix of stocks, bonds, and alternative assets can provide both income and growth potential.

6. Explore Living and Care Options

From aging in place to assisted living, there are multiple pathways. The right choice depends on your parent’s needs, preferences, and finances.

7. Advance Care Funding Solutions

Hybrid Long-Term Care Strategies: Consider hybrid policies that combine life insurance with long-term care riders. These can provide flexibility if traditional LTC insurance is unavailable or too costly [Kiplinger, June 2025].

Self-Insuring with Retirement Assets: Use coordinated withdrawal strategies from IRAs, 401(k)s, and taxable accounts, factoring in the tax advantages of medical expense deductions for LTC costs.

Home Equity Utilization: Explore home equity conversion mortgages (HECMs) or reverse mortgages as a last-resort liquidity source for care funding, while preserving other assets for heirs.

8. Maximize Government Benefits

Original Medicare (Parts A & B)

Does NOT cover most long-term care (custodial care), whether at home, in assisted living, or in a nursing home.

Medicare will cover short-term skilled nursing facility (SNF) care only after a qualifying hospital stay:

First 20 days: Medicare pays 100%.

Days 21-100: You pay a daily coinsurance ($209.50/day in 2025; subject to change), which Medigap may help cover.

After 100 days: You pay all costs.

Medically necessary home health care (like skilled nursing, physical therapy) may be covered, but not ongoing custodial care.

Hospice care is covered for terminally ill patients.

Medigap (Medicare Supplement) Plans

Do NOT cover long-term custodial care.

They can help pay for:

SNF coinsurance (days 21–100).

Hospice coinsurance/copays.

Your share of costs for Medicare-approved home health care.

No coverage for ongoing assistance with activities of daily living (ADLs) or unskilled care.

Medicare Advantage (Part C) Plans

Must cover everything Original Medicare covers (so, same limits on LTC).

Some plans may offer limited extra benefits (e.g., adult day care, in-home support) but generally do NOT cover long-term custodial care.

May offer short-term SNF or home health coverage similar to Original Medicare.

Always check specific plan details for any extra benefits.

9. Claim Tax Credits and Deductions

Caring for an aging parent can unlock several valuable tax breaks and planning opportunities. Below is a summary of the most relevant strategies, based on the latest 2025 guidance from Kiplinger, TurboTax, TaxAct, and other trusted sources.

Caregiver Tax Credits: Monitor federal and state initiatives for caregiver tax credits and paid leave programs [ZacBrownLaw, Jan 2025].

Retirement Plan Contributions: Take advantage of new laws allowing catch-up contributions for caregivers who have reduced earnings due to caregiving demands.

Turbo Tax and IRS.

10. Fraud & Exploitation Prevention

Trusted Contacts: Register trusted contacts on all major accounts to help detect and prevent elder financial abuse. Senior financial exploitation is on the rise, with elder fraud costing over $36 billion/year in the U.S. [J.P. Morgan Private Bank, 2025].

Ongoing Monitoring: Set up alerts for large transactions, changes in spending patterns, or new payees on parents’ accounts.

Educate parents about common scams (tech support, phishing, romance, grandparent scams).

Freeze credit reports with all three major bureaus if identity theft is suspected.

Planning for Medicaid

The information I am providing regarding Medicaid spend down rules is for informational and educational purposes only. Medicaid eligibility and spend down requirements are complex and vary by state. I am not an attorney and do not provide legal advice. Before making any decisions or taking any actions based on this information, I strongly recommend that you consult with a qualified elder law attorney or Medicaid planning professional to review your specific circumstances and ensure compliance with all applicable laws and regulations.

Medicaid planning is more complex and critical than ever, especially with the 2025 regulatory changes. Here’s a comprehensive summary based on the latest updates and proven strategies, with a focus on asset protection, eligibility, and practical planning steps.

2025 Medicaid Law & Regulatory Updates

Home Equity Cap: The federal home equity exemption for Medicaid long-term care is now a flat $1,000,000 (not indexed for inflation). This is a significant change from prior years and may affect clients with higher-value homes [Major Changes to Medicaid Qualification].

Semi-Annual Eligibility Redeterminations: States must now review Medicaid eligibility every six months (previously annually), increasing the risk of coverage interruption due to paperwork issues [Major Changes to Medicaid Qualification].

Shortened Retroactive Coverage: Medicaid will only cover expenses 30 days prior to application (down from 90 days). This makes timely application filing more important.

Look-Back Period: The 60-month (5-year) look-back period for asset transfers remains in place. Transfers for less than fair market value in this window can trigger significant penalty periods [Spenddown Medicaid Strategies].

Community Spouse Resource Allowance (CSRA): The maximum CSRA for 2025 is $157,920. The community spouse can keep up to this amount in countable assets [2025 Medicaid Numbers Released].

Income Cap: In most states, the monthly income limit for institutional Medicaid is $2,901 (2025).

Core Medicaid Spend-Down & Asset Protection Strategies

Important: All spend-down actions must be well-documented to withstand scrutiny during the Medicaid application process.

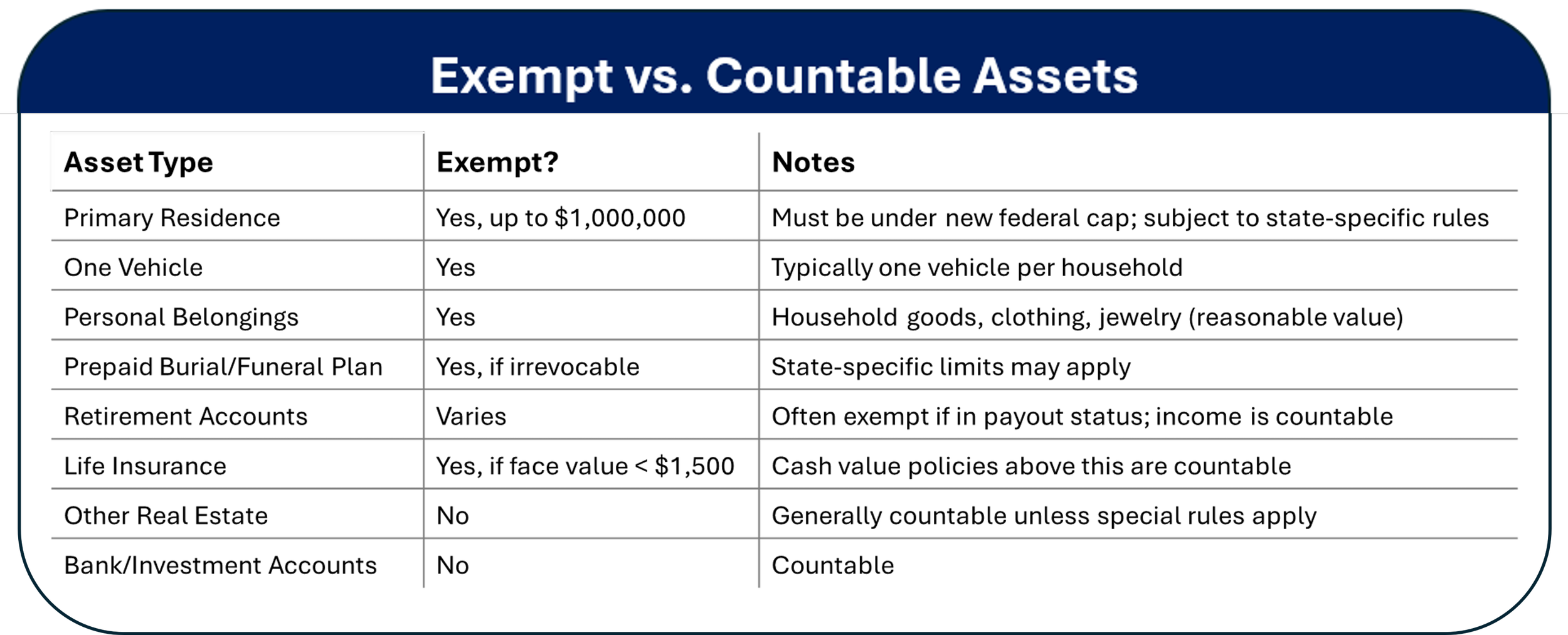

Exempt vs. Countable Assets (2025)

Key Planning Considerations for 2025

Plan Early: Because of the 5-year look-back, early planning is essential to avoid transfer penalties.

Document Everything: Keep thorough records of all asset transfers, spend-down purchases, and care agreements.

Stay Proactive: With semi-annual re-determinations, maintain up-to-date eligibility documentation to avoid interruptions.

Consult an Expert: Given the complexity and state-by-state differences, working with an elder law attorney or Medicaid planning specialist is recommended.

Resources for Further Reading:

A Definitive Guide to Taking Care of Your Aging Parents (Solace Health, 2025)

A Guide to Helping Your Parents Navigate Aging (Comfort Keepers, 2025)

Kiplinger: Your Home + Your IRA = Your Long-Term Care Solution (June 2025)

Kiplinger: How Caregivers for Adults Can Save on Taxes in 2025

How Much Should You Budget for Long-Term Care? (Morningstar, July 2025)

Ville Wealth Management is a Registered Investment Adviser in the state of Ohio. Advisory services are only offered to clients or prospective clients where Ville Wealth Management and its representatives are properly registered or exempt from registration. “Likes” should not be considered a positive reflection of the investment advisory services offered by Ville Wealth Management. Brian Jaros is an investment adviser representative of Ville Wealth Management. The firm is a registered investment adviser and only conducts business in jurisdictions where it is properly registered, or is excluded or exempted from registration requirements. Registration as an investment adviser is not an endorsement of the firm by securities regulators and does not mean the adviser has achieved a specific level of skill or ability. The information presented on this post is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Comments should not be construed as an offer to buy or sell, or a solicitation of an offer to buy or sell the investments mentioned. A professional adviser should be consulted before implementing any of the strategies discussed. Investments involve varying degrees of risk, and there can be no assurance that any specific investment or strategy will be suitable or profitable for a client's portfolio. All investment strategies can result in profit or loss.