Top 10 Retirement Planning Questions Searched on Google by those Aged 50-65

Top 10 Retirement Planning Questions Searched

1. How much money will I need to retire comfortably?

The main question for people nearing retirement is how much money they need to feel secure. In 2025, Bankrate says one-third of American workers think they need $1 million or more to be comfortable in retirement. But in reality, only 2-3% of Americans have saved that much by retirement.

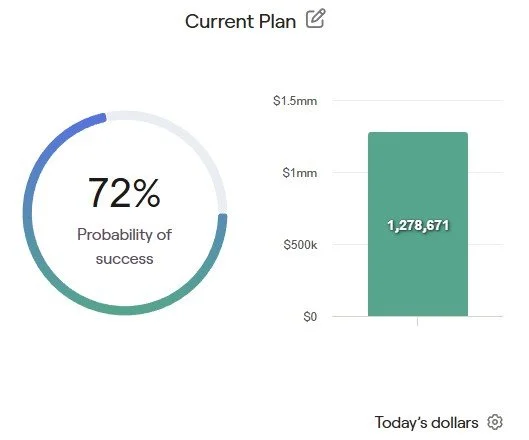

Ville Wealth Sample Retirement Plan Probability of Success based on this sample client’s unique circumstances.

The amount you need varies significantly based on your unique situation. It’s important to carefully consider your current and future expenses, lifestyle choices such as travel, hobbies, maintaining an extra home, or providing family support, as well as your long-term goals like funding education, covering healthcare costs, financing weddings, or giving meaningful gifts. Taking all of these factors into account will help you establish a realistic and personalized financial goal tailored specifically to your needs.

To get a clear and reliable answer, it’s best to talk to a professional Financial Planner, like Ville Wealth Management. They will guide you through listing your financial goals, current income, and expenses, then create a comprehensive and clear retirement plan tailored to your situation. This plan will help you understand how likely you are to retire comfortably based on your unique circumstances.

When you work with Ville Wealth Management, you gain access to a user-friendly portal where you can view and update your Ville Wealth created retirement plan anytime. You can easily make adjustments to factors such as your retirement age, spending habits, Social Security benefits, and healthcare costs. The portal instantly shows how these changes impact your chances of achieving a secure retirement. Additionally, you receive a secure online vault to safely store and organize important documents like wills, insurance policies, deeds, and passports, ensuring easy access whenever needed.

2. Will Social Security be there when I qualify for it?

Social Security’s future is a common and understandable worry, especially for individuals between the ages of 50 and 65 who are approaching retirement. It is important to know that Social Security is not going away, even if the trust fund reserves are eventually depleted, which is currently projected to occur around 2033 to 2034. Despite this depletion, ongoing payroll taxes would still continue to fund approximately 77 to 81 percent of the scheduled benefits, according to the latest estimates from the Social Security Administration’s Board of Trustees in 2025.

Ville Wealth Sample Illustration comparing the Optimal Filing Strategy vs Filing as Early as Possible.

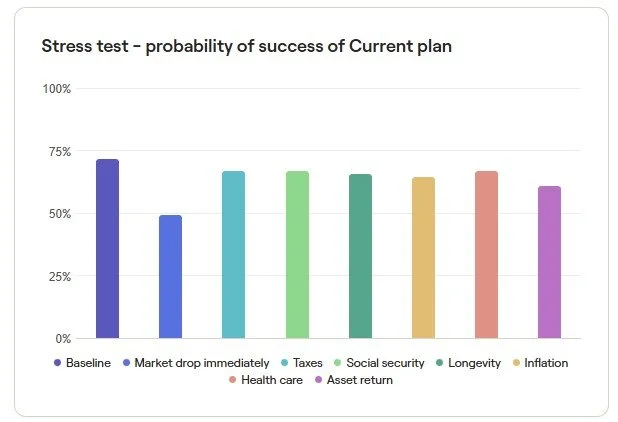

At Ville Wealth we stress test your retirement plan for many different risks.

Those who are already in their 50s and 60s tend to be less likely to experience drastic cuts compared to younger generations. Most of the proposed reforms emphasize gradual changes and commonly include protections for individuals who are nearing or currently in retirement. Many of my clients choose to run projections assuming a 20–25% reduction in benefits as a form of “stress test” to better prepare for potential future scenarios.

3. What if inflation rises when I’m retired?

Inflation is a major worry for people nearing or in retirement, especially after recent high inflation rates. Inflation is normal but when it rises more than expected, it reduces how much your money can buy, which matters a lot over a long retirement. On average, inflation has been about 2–3% per year but can sometimes jump higher. Even normal inflation increases living costs significantly over 20 to 30 years. Healthcare costs usually rise faster than inflation, making planning harder.

At Ville Wealth Management, we include inflation in your retirement plans, usually assuming 2–3%, and we stress test your plan against higher inflation too. Social Security benefits increase with inflation through annual cost-of-living adjustments (COLAs), offering some protection. Having a diversified portfolio with stocks and growth assets helps your investments grow faster than inflation. We suggest holding assets like stocks (utilizing ETFs or Direct Indexing), Treasury Inflation-Protected Securities (TIPS), and real estate, which tend to keep up with or beat inflation. Inflation is a real risk, but your retirement plan can be carefully built to handle it.

4. Is it possible I could outlive my savings?

Ville Wealth Sample Cash Flow Ending Account Balance Illustration.

Longevity risk means the chance you might run out of money if you live longer than expected. Many people nearing retirement worry about this. To manage this risk, we use advanced planning tools that test many possible market and spending scenarios to see if your savings will last through retirement. At Ville Wealth we plan for your money to last until age 90 to 95, giving extra safety for a longer life. By keeping your investments spread across stocks, bonds, and other assets, your portfolio can grow and stay strong during market drops. We also review your plan every year to track progress and make changes if needed.

According to the Society of Actuaries (SOA), a 65-year-old male today, in average health, has a 54% probability of living to age 85. For a 65-year-old woman, the probability of reaching 85 is higher, at 65%. Several important factors impact longevity, including education level, genetic background, and gender. Additionally, the overall health and safety of the neighborhood you live in, your personal health and safety habits, and your access to quality medical care play a significant role. Other influential elements include your medical knowledge, how consistently you follow medical advice, and the strength of your social connections.

5. How can I plan for potential long-term care needs?

Long-term care (LTC) represents a significant risk during retirement that many individuals often overlook. Approximately 70% of people over the age of 65 will require some form of long-term care at some point in their lives, and the associated costs can be substantial, often exceeding $100,000 per year for nursing home care alone (AOL/SmartAsset, 2025).

It is important to note that Medicare does not cover most long-term care expenses, which can place a heavy financial burden on retirees and their families. There are four main planning options to consider when preparing for LTC needs: Self-Funding, Long Term Care Insurance, Medicaid Planning, and Family Support. For more detailed guidance on this important aspect of retirement planning, we recommend referring to Ville Wealth Management’s comprehensive resource, Caring for an Aging Parent.

6. How will taxes impact me in retirement?

Retirement tax planning is important for many people nearing or in retirement. Common questions include: Should I do Roth conversions to save on taxes? How can I reduce taxes on my retirement withdrawals? What does the new senior tax deduction mean, and how do Required Minimum Distributions (RMDs) affect my taxes?

It's important to know how retirement income is taxed. Up to 85% of Social Security benefits can be taxed depending on your income. Withdrawals from Traditional 401(k)s and IRAs are taxed as regular income. Qualified withdrawals from Roth IRAs and Roth 401(k)s are tax-free. Pensions are usually taxed as regular income. Income from brokerage accounts, like capital gains, dividends, and interest, is taxed differently depending on the type. RMDs must start at age 73 for most people. These required withdrawals can increase your taxable income and move you into a higher tax bracket if not managed properly.

To effectively manage taxes in retirement, it’s important to consider strategies such as withdrawal sequencing, which means deciding which accounts to draw from first to minimize your overall tax burden throughout your lifetime. Roth conversions can be a powerful tool for managing your tax bracket, allowing you to pay tax now and enjoy tax-free withdrawals later. Please review the Opportunity Valley strategy developed by Ville Wealth Management, which offers insightful guidance on this complex topic.

7. How should I budget for healthcare expenses in retirement?

Healthcare costs often rise faster than other expenses and can be unpredictable in retirement. Fidelity estimates that a typical 65-year-old couple retiring in 2025 may need over $315,000 for healthcare during retirement, excluding long-term care. Key costs include Medicare premiums (Parts B, D, and supplemental plans), deductibles, copays, coinsurance, prescription drugs, and routine dental, vision, and hearing care, which Medicare usually doesn’t cover. Out-of-pocket limits and uncovered expenses add up too. Long-term care, often not covered by Medicare, requires separate planning. On average, retirees spend $5,000 to $7,000 per person each year on premiums and medical costs, not counting long-term care.

Healthcare costs usually rise 4% to 6% each year, often faster than general inflation. It's important to include these increases when planning your retirement budget. If you’re still working and eligible, try to put as much as you can into a Health Savings Account (HSA) because the money grows tax-free and can be used for medical expenses anytime.

If you retire before 65, plan for more expensive private insurance like COBRA or ACA plans (Affordable Care Act), which cost more than Medicare. Review and update your healthcare budget every year to reflect changes in premiums and medical needs.

At Ville Wealth we can help you estimate your yearly costs for Medicare, extra insurance, medications, and out-of-pocket expenses. For a 65-year-old couple, this could mean setting aside $6,000 to $7,000 annually, plus extra for dental, vision, and possible long-term care. For more Medicare Planning information review Ville Wealth’s Plan for Medicare by Age 62.

8. What’s the best age to retire?

The best retirement age depends on your goals, health, money, and lifestyle. Some retire before 62, others wait until 65 or even after 70 for personal or financial reasons.

Social Security pays less if you claim at 62, more if you wait until 70 (about 8% more each year after full retirement age). Medicare starts at 65, so if you retire earlier, plan for private health insurance.

Think about your health when deciding when to retire. Does your job offer valuable benefits? Also, consider if you want to keep working for purpose or social reasons. Family is important. Do you support others or want to retire with your spouse?

Make sure your savings cover your lifestyle and health care until Medicare kicks in. At Ville Wealth, we will review your income, expenses, health, family, and preferences to help you choose the best time to retire confidently. For Social Security timing details, refer to Ville Wealth’s Social Security Blog.

If you want to retire between age 55 and 59½, learn how to avoid the 10% withdrawal penalty. Refer to Ville Wealth’s Retirement Hack - Rule of 55.

9. What happens if the market drops when I’m retired?

Keep Cash for Spending: Have enough cash to cover 1-2 years of spending. Most bear markets last about 9.5 months, so this cash acts like insurance.

Don’t Invest Short-Term Money: Funds needed in the next 7 years should not be invested in the stock market, instead invest in cash and fixed-income instruments.

Rebalance Regularly: Reassess your investment portfolio every quarter, or consider establishing a drift threshold, such as 25%, to ensure that it aligns with your individual risk preferences.

Maintain Asset Allocation: Asset allocation plays a crucial role in helping you effectively balance your individual risk tolerance, specific time horizon, and overarching financial goals. Asset allocation is regarded as one of the most significant factors impacting your investment outcomes.

Keep Fees and Expenses Low: Utilize lower-cost exchange-traded funds (ETFs) for your retirement accounts and carefully consider a strategic combination of both ETFs and Direct Indexing for your taxable accounts, especially for investors who are situated in a higher tax bracket. This approach can help optimize your investment returns while minimizing tax liabilities over time.

Update Your Financial Plan: A well-structured and current financial plan will play a vital role in helping to protect your retirement, even during economic downturns, especially if you consistently adhere to the previous tips provided. By implementing these strategies, you can build a stronger foundation for your financial future.

Refer to Ville Wealth’s Market Volatility Blog for more information.

10. Do I need to update my estate plan and beneficiaries?

Keeping wills, powers of attorney, and other estate documents up to date is important for people in this age group. Estate planning isn’t just for the very rich, as it’s essential for anyone who wants control over how their assets are shared and to protect their family’s finances. Old or outdated documents can cause problems like delays or disputes.

It’s especially important to update these papers after big life changes like marriage, divorce, having or adopting a child or grandchild, the death of a family member, big financial changes, or moving to a new state. Even without major changes, review your estate plan every 3 to 5 years to keep it current.

Also, changes in laws, like tax or estate rules, might mean your plan needs updating. When you check your estate documents, look at your wills, trusts, powers of attorney, and healthcare directives to make sure they still fit your needs. Check who you’ve named to make decisions for you and if it’s still correct.

Double-check beneficiaries on things like retirement accounts, life insurance, annuities, and bank accounts since these usually override your will. Make sure they still reflect your wishes and current family situation. If you have minor kids or dependents, update guardianship choices. Finally, ensure your accounts and property titles match your plan to avoid problems.

Regular updates give you peace of mind and help your assets pass on as you want.

5 Additional Bonus Questions

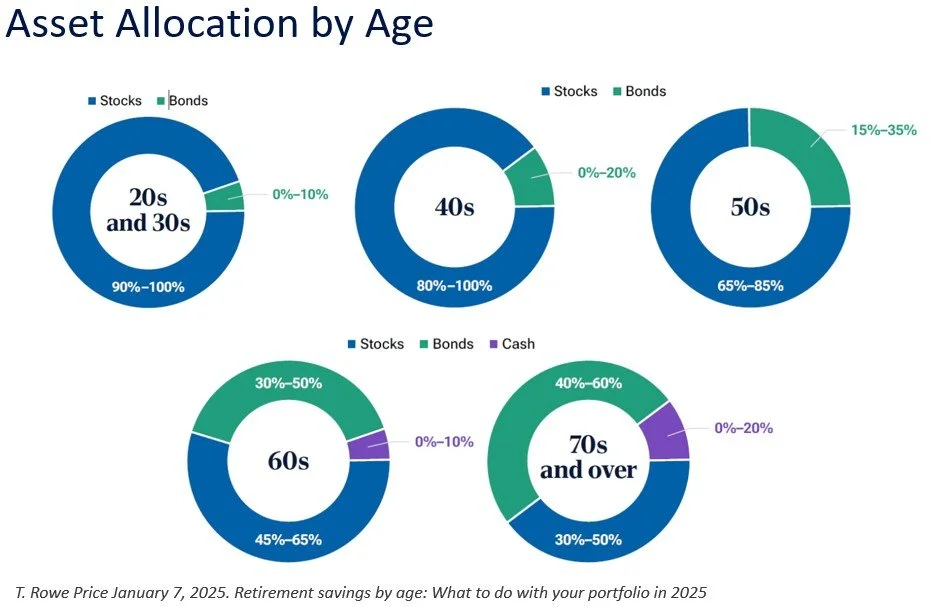

1. Should I reduce my equity exposure as I near retirement?

As you near retirement, many people choose to slowly reduce their stock investments to protect their savings from big market drops. Losing money just before or after retiring, called “sequence of returns risk”, can seriously hurt your finances in retirement. Cutting back on stocks lowers risk and keeps your portfolio steadier but also limits how much your money can grow over time. Since retirement can last 20 to 30 years or more, keeping some stocks is usually needed to beat inflation and support withdrawals.

It’s important to review your plan based on your goals, how much risk you’re comfortable with, any guaranteed income like Social Security or pensions, and how much you’ll need to withdraw each year to live comfortably.

2. Should I consider long-term care insurance now or wait?

Long-term care (LTC) insurance is usually cheaper and easier to get if you buy it in your mid-50s to early 60s, before health problems start. Premiums go up as you get older and can be much higher if you wait until your mid-60s or later. Delaying can also mean you might be denied coverage if your health worsens. Experts suggest looking into LTC insurance between ages 55 and 65 to get better prices and availability. Hybrid policies, like life insurance with LTC options, can provide more flexibility and extra benefits to protect your financial future.

3. How do I handle taxes on capital gains and withdrawals?

Ville Wealth uses tax-smart withdrawal strategies and may sell investments at a loss to reduce taxes. Each year, we estimate your taxes so you can adjust your withholding or make estimated payments. We will review your accounts and withdrawals with you to help avoid unexpected tax bills.

4. What’s the right sequence for drawing down accounts (Taxable, Tax-Deferred, Roth)?

The typical sequence for managing your retirement withdrawals generally follows this order:

Taxable Accounts (Brokerage, Joint, Trust): Use cash, dividends, and carefully sell assets that have increased in value to control capital gains. Start here because you only pay tax on profits, usually at a lower rate than regular income tax. Using these accounts first lets your tax-advantaged accounts keep growing without taxes for longer, boosting their growth.

Tax-Deferred Accounts (Traditional IRA, 401(k), 403(b)): Money you take out is taxed as regular income. Usually, start withdrawing from these after using taxable accounts or when you must take required minimum distributions (RMDs) starting at age 73. This helps control your taxes over time.

Tax-Free Accounts (Roth IRA, Roth 401(k)): Withdrawals from Roth accounts are tax-free. It's smart to use these accounts last to get the most tax-free growth. They also help you control your taxes in retirement by giving you flexible income options.

Why follow this withdrawal order? It lets your tax-advantaged accounts grow longer without yearly taxes. Taking money from taxable accounts first can keep your income lower for taxes early in retirement. Using Roth accounts wisely helps avoid higher taxes or extra Medicare costs when you need more income.

Sometimes, it’s smart to take money out of IRAs or 401(k)s before the required minimum distributions or before age 73 (refer to Opportunity Valley). This can help use lower tax brackets or make Roth conversions, which can save on taxes. If you have big medical expenses or special situations, the best withdrawal plan might change. Since everyone’s finances are different, we suggest doing detailed yearly reviews to adjust your plan and keep your retirement income on track for your goals.

5. Will I have enough to leave behind assets for loved ones / charity?

Leaving a legacy for family, charities, or causes you care about is important. Including legacy planning in your retirement plan helps make sure your wishes are followed while keeping your finances safe during your life.

How Legacy Planning Fits Into Retirement: Ville Wealth first ensures your retirement income and healthcare costs are covered and sustainable. Then, we estimate what assets may remain based on your spending, life expectancy, investments, and potential care costs. This helps us create a clear legacy plan.

Gifting Strategies: If you want to give gifts during your lifetime, we explore options like annual gifts, charitable trusts, or donor-advised funds. These can lower taxes and let you give while you're still active.

Legacy planning starts by protecting your finances and continues with careful planning for what you leave behind. We suggest regular reviews and testing different scenarios to keep your plan current with your life, market, or tax changes. The right estate and gifting plans help your legacy support your family and causes you care about most.

Ville Wealth Management is a Registered Investment Adviser in the state of Ohio. Advisory services are only offered to clients or prospective clients where Ville Wealth Management and its representatives are properly registered or exempt from registration. “Likes” should not be considered a positive reflection of the investment advisory services offered by Ville Wealth Management. Brian Jaros is an investment adviser representative of Ville Wealth Management. The firm is a registered investment adviser and only conducts business in jurisdictions where it is properly registered, or is excluded or exempted from registration requirements. Registration as an investment adviser is not an endorsement of the firm by securities regulators and does not mean the adviser has achieved a specific level of skill or ability. The information presented on this post is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Comments should not be construed as an offer to buy or sell, or a solicitation of an offer to buy or sell the investments mentioned. A professional adviser should be consulted before implementing any of the strategies discussed. Investments involve varying degrees of risk, and there can be no assurance that any specific investment or strategy will be suitable or profitable for a client's portfolio. All investment strategies can result in profit or loss.